SBA Loan

The world has totally changed in every aspect- the people, government and their new rules, even updates on new career options. But, there are things beyond all these. Have you heard of SBA Loan? This has been a very helpful tool for the middle class people who would want to start their own business.

This could be an option for those who just completed their education and would like to be in and around their hometown itself. However, If these belong to rural areas, do you think they could afford a big business? How would they get enough financial support? Here, comes the role of the so called SBA Loan.

People could start a small business in their hometown and they could request for a loan adequate to commence it. Isn’t that a fair deal? However, as every thing around us has its own good and bad sides.

So, Let’s have a look at the pros and cons of SBA loans :

SBA LOAN PROS:

# Minimum down payments

# Longest duration for repayment

# Reasonable interest rates

# Suitable for a wide range of business needs

SBA LOAN CONS :

- Lengthy paperwork

- Takes longer time to get approved

- Require security or warranty

SBA Loan: Review

There are several SBA Loan programs under the US Small Business Administration, wherein money can be borrowed for absolutely any business needs, which includes additional working capital, purchase of inventory or equipment, taking loan for other debts, buying real estates or achieving funds for other businesses.

Who are qualified for SBA Loan?

There are basically three essential points that one must see . Inorder to analyse whether you are eligible for SBA loan . Given below are the following checklist for SBA Loan eligibility criteria :

a) Should have 2+ years in business

b) 640+ credit score

c) Annual revenue more than $100,000

SBA Loans: Types

SBA Loan has several programs. However, choosing a wrong loan type could result to losing a lot of relevant benefits.

When purchasers talk about these loans, they refer to SBA 7a or the SBA 504 loan for the Commercial Real Estate. SBA Loan is classified into 6 types:

Here begins with SBA loan types and their eligibility and other details .

TYPE 1 : SBA 7(a) Loans

These are the most common types of SBA Loan. The amount in this loan type could be upto $5,000,000 and could be used for the working capital, reapplying for debts; buy a business, real estate or a machinery. This loan program comprises SBA Express Loans and SBA Advantage Loans.

SBA 7(a) Loans can be given to both-startups as well as to the established small businesses. To qualify for this loan type, one need to have the following:

# A good credit score, preferably 680+

# No recent indebtedness,mortgages or tax charges

# Collateral : As SBA does not refuse to give loan due to insufficient collateral or warranty, there are less chances of a lender giving loan which does not have enough security or warranty. Loans under $25000 need not be warrantied.

# Down payment of 10% if the loan is to purchase a business, real estate or a machinery/equipment

These are the basic eligibility for SBA 7(A) Loans .

| Use of Loan Revenue | 1. Working capital 2.Equipment Purchases 3. Refinance debt 4. Purchase of Business / franchise 5. Leasehold improvements 6. Purchase of commercial real estate |

| Minimum Requirements | a ) 680 + credit score b ) 10 -20 percent down payment c ) Securities ( Not mandatory in all cases) |

| Interest Rates | 5.75 % -8.25 % |

| Loan Amount | Upto 5 million dollars |

| Repayment Terms | 25 yrs – commercial real estate loans 10 yrs – Working capital loans |

How To Apply for SBA 7(a) Loans :

The top 3 banks providing SBA Loan are: Wells Fargo, Live Oak Bank & US Bank. These Banks, have done over 7500 SBA 7(a) Loans, summing to more than $2.8 billion in 2016. Almost all national and regional lenders would participate in this loan program. A Regional SBA office would refer its customer to the participating lenders in one’s area; or they could work with Nationwide SBA Loan provider like SmartBiz.

One can apply for SBA 7(a) Loans in 4 steps:

Determine Eligibility

This step verifies if an individual or a business is eligible for the loan. Both, the general borrower requirements as well as the SBA eligibility requirements have to be met.

SBA Loan Requirements :

a ) 680+ FICO score for all primary business owners.

b ) Down payment of 10% or more loan is used to purchase a business or commercial real estate.

c ) Collateral: SBA loans need not have 100% warranty. But the more business and/or personal security brought, the easier it will be to get the approval.

d ) 2+ years in business: Startups can get SBA 7a loans, however it is more complicated. If one needs SBA loan as a startup, they to have all the mentioned, along with business management & industry experience.

e ) Business is profitable

f ) No offenses or defaults on debt obligations to the U.S. government (including student loans).

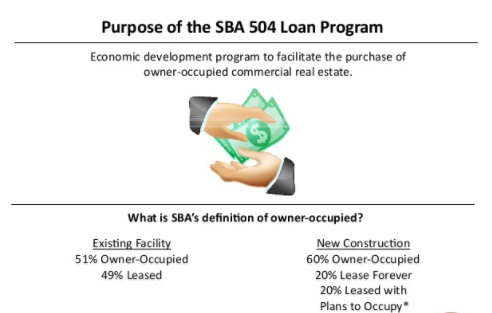

g ) Commercial real estate loans must be owner-occupied by 51% or more.

Find SBA Loan Provider:

As the above requirements are met, the next step is to find a provider of SBA Loan, distributing and servicing the loan. SmartBiz is fast and efficient. Their updated process would pre-qualify in a ‘Nick of time’ and get funded as fast as 30days.

Finding SBA Loan provider would mean direct connection with the Bank and other direct lenders or brokers.

a ) Finding a direct SBA lender- Banks, Credit Unions, Non-Bank Lenders:It is quite ideal to have a Bank which regularly provides SBA Loans. These loan providers easily approve the application and also know how to solve any issues that the borrower faces.

One has to be sure that the lender is a part of SBA Preferred Lender Program(PLP). PLP lenders are those SBA Loan providers having great deal of experience and a strong record which could make SBA give them more flexibility in processing the loan faster.

b ) Finding SBA Loan broker : Loan brokers provide valuable service to people owning small businesses by influencing them through their knowledge. Brokers strongly understand who would easily approve the type of loan and business, as well as the style of presenting the request for business loan.

Meanwhile, SBA Loan brokers could save a lot of time and irrelevant complications by coordinating lender’s document requests and similar communications. When a Bank is found, directly or through a loan broker, one should collect as much information regarding the SBA interest rates they provide and the fees. SBA sets a margin on the interest rates; however the rates may differ from one Bank to another. The borrower should read the article on SBA Loan rates before applying for the loan, and once being pre-approved, an SBA Loan Calculator to have the right estimations on the monthly payments.

Assemble and Organize SBA Loan Paperwork:

Once the lender or the broker is selected, the next step is assembling the documents required for the application. SBA has a broad checklist of documents which are as follows:

# Loan Request Amount & Detailed Allocation of Funds

# Business Financials

# Profit and Loss (P&L) Statement

# Balance Sheet

# Projected Financials (1-3 years)

# Proof of Ownership

# Business Certificate/License

# Loan Application History

# Business Tax Returns (last 2 years)

# Personal Tax Returns (last 2 years)

# Personal Financial Statement

# Owner Résumés

# Business Overview and History

# Business Lease

Complete SBA Forms:

Besides the paperwork mentioned, there are certain forms to be filled so as to get the loan approved. Following are the broad guides on how to fill SBA loan form and complete the forms:

# SBA Form 1919 Guide: Borrower Information Form – Used for all 7a loans, the form where basic borrower information is noted

# SBA Form 912 Guide: Statement of Personal History – This form is used to evaluate the character of the borrower

# SBA Form 413 Guide: Personal Financial Statement – This form is used to assess the personal financial status of the borrower,their spouse (applicable), and anyone who is a proprietor of the business.

# SBA Form 159 Guide: Fee Disclosure Form and Compensation Agreement – This form is relevant only if an outsider is hired to help with SBA loan application. It comprises the details how much is paid and the services they provided.

TYPE 2 : CDC / SBA 504 Loan- Owner Occupied Commercial Real Estate Loans

The CDC (Community Development Corporation) or SBA 504 Loan Program is created to avail affordable long term loans for small businesses, trying to buy or build facilities, as well as provide facilities through heavy equipment with longer lifespans.

The program combines two lenders for funding these projects:

@ Bank, Credit Union, or Non-Bank Lender – Lending up to 50% of the project costs

@ Community Development Corporation (CDC) – Lending up to 40% of the project costs

The 10% is contributed by the borrower as down-payment.

Use of SBA 504 Loan:

| Loan Revenue |

|

| Minimum Requirements |

|

| Interest Rates | 3.78 – 5.39% |

| Loan Amounts | Up to $14 million |

| Repayment Terms | 10 or 20 years |

For a business to be qualified to apply for this SBA Loan type, it should pass the following criteria:

@ Credit Score to be 660

@ 10% Down-payment of the project cost

@ Job creation or Public policy goals to be met

@ Have a reachable Net worth of less than $15 million; an average Net income less than $5 million after taxes during the previous 2 years

@ Not to be engaged in any venture or Investment in rental Real Estate

@ No funds to be taken from external sources

@ Have the capability to repay the loan on time from the Operating Cash Flow of the business

Interest Rates, Terms & Limits:

The SBA 504 Loan is classified to two types: One is for 50% or less of the deal issued by the lender like Banks, Credit Unions or Non-Bank lenders; others are issued by CDC for 40% or lesser to the deal. Both these loans differ in terms, rates & limits. Together, these rates sum up to a total of 504 loan rates.

- CDC’s Role in SBA 504 Loan:

CDC type of SBA Loan covers up to 40% of total project cost. SBA keeps limits on the interest rates,terms and fees that must be followed by CDC. The loans must have terms- 10 or 20 years and the interest rate must be fixed.

- Bank/Non-Bank Lender’s Role in 504 Loan:

The Bank, Credit Union or the Non-Bank lenders issuing other loans cover up to 50% of total project cost. SBA does not keep limits on the rates, terms and fees for the traditional lenders, thus leaving the loan details for negotiation. Interest rates would be between 4%-8% having a reset point. Usually, a loan has a term of 5-10 years but would be repaid in 20-25 years. the repayment schedule refers to a lower monthly payment; however it can be higher when then loan matures.

- CDC/SBA 504 Loan Public Policy Goals:

SBA has set certain rules for promoting job creation, community development and other Public Policy goals.

Job Creation is promoted by requiring businesses to make or hold on to a job for every $65000 loan, except for small businesses who would receive $100,000 for every job created or held on.

Community Development Goals comprise promoting business district recovery, expanding the exports, minority expansion, women or high-profile businesses, rural development or energy efficiency and many more.

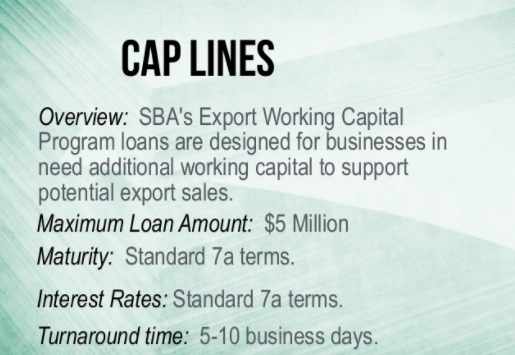

TYPE 3 : SBA CAPLines Program- SBA Line of Credit

This SBA Loan program is of 5 types, created to avail up to $5 million in helping small businesses to cover up their short-term and seasonal Working Capital needs. Let us have a look at the types of CAPLines:

Seasonal Line of Credit: Used for seasonal increase in Accounts Receivable, inventory needs, or related increased labor costs up to $5,000,000.

Contract Line of Credit: Used for the materials and labor associated with assignable contracts.

Builders Line of Credit: For contractors engaged in building or renewing residential or commercial buildings used for materials, equipment, permitting, labor, and even land related to a project.

Standard Asset-Based Line of Credit: Allows small businesses in converting short-term assets (such as pending invoices) into cash.

Small Asset-Based Line of Credit: Allows small businesses in converting short-term assets e.g. pending invoices, into cash. Firm servicing requirements are removed by the SBA in return for offering a smaller credit line. Up to $200,000.

Uses:

| Use of the Loan |

|

| Minimum Requirements |

|

| Interest Rates | 5.75 – 8.25% |

| Loan Amounts | Up to $5 million Small asset-based lines have a limit of $200,000 |

| Repayment Terms | Up to 5 years |

Eligibility or Qualification:

Eligibility criteria for CAPLines program of SBA Loan is the same as that of SBA 7(a) program, but with a few additional points. Criteria are as follows:

# A good credit score, preferably 660+

# No recent bankruptcies, mortgages, or tax charges

# Short-term warranty, like invoices or assignable project contracts

# Personal guarantee from owners of 20% or more

# Some additional security (the more, the better)

The Additional points vary according to SBA Line of Credit being applied for.

SBA Seasonal Line of Credit requires a business having operated for at least 1 year and that they show up their varying nature of the business.

SBA Contract Line of Credit requires a business that wins a contract or a subcontract, or having received a purchase order that can be used as a base on the line of credit.

SBA Builders Line of Credit is for the small contractors or developers in constructing or re-establishing residential or commercial property sold to the third-party, who are not known at the time of construction or at the beginning of re-establishment. The purchase of a land cannot exceed 20% of the CAPLine revenue.

How To Apply:

The application process of this type of SBA Loan through CAPLines program is similar to SBA 7(a) loan. Lenders such as Banks and Credit Unions who get involved in SBA 7(a) loan program would also take part in CAPLines program. There requires other set of businesses to be taken to the lender so as to find the security for SBA Line of credit to be worthy of it.

Read Also : Quickly increase credit score in just 12 months -Easiest hack

READ ALSO : Survive high interest student loans – Amazing Tips

Read Also : Exclusive Nest Egg building guide for painless millionaire dreamer

TYPE 4 : SBA Export Loans

This SBA Loan types is made to help the small businesses of Americans in expanding their export activities, be involved in international transactions and to enter new foreign markets. There are 3 types of Export Loans:

SBA Export Express Loan: Updates funding up to $500,000 in working capital to promote small businesses having export activities. Terms up to 7 years.

SBA Export Working Capital Loan: Funding up to $5 million in working capital to fund export transactions, while the small business having a purchase order from a foreign customer. Terms usually under 12 months, extending to 3 years.

SBA International Trade Loan Program: Funding up to $5 million in working capital and/or fixed assets for export businesses or for businesses negatively influenced by imports. Terms up to 25 years.

| Use of Loan | To develop or expand small business exporting |

| Minimum Requirements |

|

| Interest Rates | SBA Export Working Capital Loan: No Limit (but monitored for authority)

SBA Export Express Loan: 8 – 10% International Trade Loan: 5.75 – 8.25% |

| Loan Amounts | Up to $5 million

SBA Export Express: up to $500,000 |

| Repayment Terms | SBA Export Working Capital Loan: Up to 7 years

SBA Export Express Loan: Up to 3 years International Trade Loan: Up to 25 years |

Eligibility or Qualification:

The qualification criteria of this type of SBA Loan resembles that of SBA 7(a) loan program, with a few differences depending on the type of Export Loan being applied for. Following are the criteria:

- Credit Score of 660

- No recent bankruptcies, mortgages, or tax charges

- Personal guarantee from owners of 20% or more

- Some additional security (the more, the better)

Additionally, the Export Express Loan requires a business to be in existence for at least a year, with with an overseas export. One need not have a necessary experience of a year in overseas export, as long as the principles show relevant exporting experience.

The Export Working Capital loan does not have borrower requirements like that of SBA 7(a) program, except that, a Short-term working capital need to be shown so as to enable export expansion.

Lastly, the SBA International Trade Loan, where the borrower must show that they can develop new foreign markets, expand existing markets, and also show that the small business was adversely affected by imports and the loan would increase the competitiveness.

Read Also : Mutual Fund A Complete Guideline – All You should Know

Read Also : Investment on Stocks and Shares -Pros and Cons

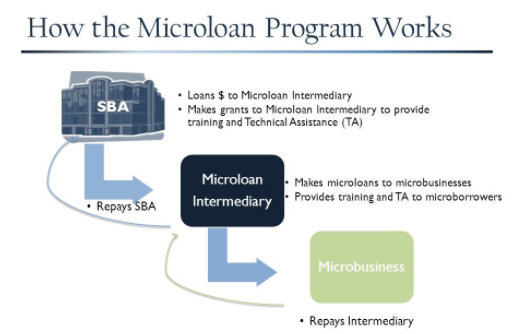

TYPE 5 : SBA Microloan Program

This SBA Loan program offers loans to non-profit agent lenders who lend an mount under $50,000 to profit oriented small businesses and non-profit child care centers. The SBA does not assure any portion of loans made under this SBA Loan program. Microloans term up to 6 years with an average size being $14,215.

Non-profit agents are allowed to borrow up to $750,000 during the initial year, followed by $1025 million each year thereafter, however cannot borrow $5 million at once from any lender.

| Use of Loan Proceeds |

|

| Minimum Requirements |

|

| Interest Rates | 8 – 13% |

| Loan Amounts | Up to $50K |

| Repayment Terms | Up to 6 years |

Uses:

This SBA Loan type can be used as Working Capital to purchase the following:

- Materials and supplies

- Furniture and fixtures

- Marketing and advertising

- Inventory

- Equipment

- Labor

The only limitation of SBA Microloan is that it cannot be used in real estate or reinvesting in debt.

If one shows interest in SBA Microloan program, would also be interested in Community Development Financial Institution(CDFI) helping them.

Eligibility or Qualification:

The qualification for this SBA Loan type differs from agent to another. Unlike other SBA Loan programs, SBA Microloan lets the agents have qualifications, who would keep their eligibility requirements and make certain credit decisions. We shall now have a look at the basic eligibility requirements:

- Credit score above 660

- Some warranty or security

- Personal assurance

How to Apply:

To apply for SBA Microloan, one must be working with SBA approved agent in their area. As the name says, SBA Microloan is smaller in size, taking time to obtain, as long as that of SBA 7(a) loans, which could be several months.

One way of improving differences to be approved for SBA Microloan is the presentation of a professional application. Gather all the financials and create a clear, respectable Business Plan with financial estimates. Business plan software, LivePlan for instance, having a 6o day money back guarantee could ensure covering all the bases.

TYPE 6 : SBA Disaster Loans

Generally, these SBA Loan types are for recovering from a stated disaster, or loss of a significant employee. Each Disaster loan can be used in different ways and can apply for multiple types of this loan can be applied, at the same time to meet the business needs. We shall have a look at the 3 types of Disaster Loans for small businesses:

SBA Business Physical Disaster Loans (BPDLs):

Long-term, low-rate loans made to help businesses suffering physical losses and damages due to a declared disaster, replacement or repair of that property not covered by insurance. It need not to be a profit oriented business.

SBA Economic Injury Disaster Loans (EIDLs):

Short- to medium-term working capital loans in helping businesses that suffer a major economic crisis, in meeting usual operating expenses.

SBA Military Reservists Economic Injury Loans (MREIDLs):

Short- to medium-term working capital loans to help businesses who lost a significant employee being wanted for active military service; meeting normal operating expenses.

| Use of Loan Proceeds |

|

| Minimum Requirements |

|

| Interest Rates | 4 – 8% |

| Loan Amounts | Up to $2 million |

| Repayment Terms | Up to 30 years |

SBA Loan Eligibility or Qualification:

The eligibility requirement for this SBA Loan eligibility program type differs slightly. A very significant difference is that one may not be in a right state of health when applying for this SBA loan. However, they still have to fulfill their eligibility requirements:

@ Applicants should have adequate credit history, which means that they should not have financial losses, mortgages or tax charges excessive load of liability

@ Applicants can show the ability to repay the loan and other liabilities

@ Security is required to protect the loans as much as possible through personal and business assets

@ Need not be for a bprofit-oriented business except for MREIDL

A person is eligible for SBA Business Physical Disaster Loan if their business has been physically damaged by a disaster within the disaster declared area.

SBA Economic Injury Disaster Loan eligibility is for those small businesses that suffered massive economic loss by the disaster and are not able to meet the usual operational expenses.

A person is qualified for SBA Military Reservists Economic Injury Loan if the particular employee has been called for active military duty and the loss leads to the inability to meet the usual operational expenses.

How To Apply:

Before the application for this SBA Loan program, it should be verified that the disaster affecting the business is qualified for the SBA Disaster Loan support by checking SBA’s disaster database.

Read Also : Short term Investment Plans – Pros & Cons

SBA Loans Tips- How to choose the right kind of SBA loan

Generally, these small businesses are great strength to the US economy. According to the US census record of 2010, there have been 27.9 million small businesses registered in the United States, where around 120 million people were employed, that would be half of the nation’s manpower.

We have gone through different types of SBA Loan and its uses and where they could be applied. Each type has its own significance.

When in a small business, requiring extra capital to take the business into the next level, a few key points can be considered. Here are the following:

# Review the Business Finances: Before taking up a financial option, one must review the records thoroughly so as to make sure that the business is in the right place to get the loan approved. Many lenders would require a documentation showing the history of a strong performance, hence having more chances of repayment. There are Book-Keeping tools such as Xero, Sage & QuickBooks enable in documenting the incomes and expenses, thus providing detailed report of business performance.

# Be Cautious Before Borrowing From Family and Friends: Earlier, in businesses, entrepreneurs self-funded from their personal savings, credit cards, or borrowed capital from family and friends.

PROS: While taking capital, these people are the ones who know us well, who would realize the talent and passion, supporting in every step we take.

CONS: Depending on the family and friends would bring limited funds. Combination of business and personal relationship needs gentle balance, being reminded of the risks involved.

Conclusion: While having certain benefits in sharing successes with family and friends, there could be more risks involved in short-term financial gains.

3. Use Credit Cards carefully: As these enable quick-funding and instant access for different business needs, the credit cards enable the entrepreneurs to fund emergency expenses in business.

PROS: Easy to access for any business expenses from anywhere

CONS: Some entrepreneurs have very low credit lines to make a significant effect on the business goals. Moreover, customers using more than 50% of credit line, would have lesser credit score, which not only reduces cost of personal borrowing, but also makes borrowing from Bank more expensive.

Conclusion: Credit Cards could make a reliable instrument for cash management. They could be more useful during the initial phases of business growth, however could limit in the long term plans.

4. Don’t Totally Rely on Bank Loans: In the Past, the small business entrepreneurs had only one option to depend on Banks for funding in their business, wherein long paperwork was involved and had taken long time.

PROS: When a person goes for an SBA Loan, they usually pay a lower interest, when compared to other options.

CONS: Banks maintain the biggest limits by lending larger amount than that sought by the entrepreneurs. Here is why the entrepreneurs lose their importance by many Banks. Banks taking longer time to review and requesting the documentations, leading to the rejection most of the time, would not suit the small businesses all this time on their businesses.

Conclusion: If the business is new, and does not hold a well formed track record of strong performance, one has to seek beyond the traditional Bank loans to fund into small business.

5. Consider Online Lenders: As the number of entrepreneurs increases, who look out for funding that suits the new age, there has been an awakening of newer, technology-based lenders, who offer better adaptability, being faster than most traditional funding methods.

PROS: Tech-enabled lenders don’t ask the borrower to make endless financial records or wait for a longer time for a decision. Once applied online, they have a decision on the basis of latest business data, with access to capital instantly.

CONS: Certain online loans hold a higher interest compared to the traditional Bank loans.

Conclusion: If the business is not qualified for a traditional loan, there are a few innovative companies like Kabbage would make it possible for small businesses to access the funding so they could grow.

We have been through every aspect of SBA Loan, its types, the eligibility for each loan, how to apply for specific type of loan, and finally about Choosing the right type. These loans would always be a helpful medium to keep their businesses grow to greater heights, especially after reading through the tips of choosing the suitable SBA Loan.

0 comments