Most of the people are not actually familiar with the term, What is online trading or online investment ? How to invest without broker ? etc etc. This article will help you to know online trading or investment. Online trading or investment is the process of trading through internet in which people or investors buy/sell shares or goods for financial security or further investment for future.

We can also call it Direct Access Trading, it is a technology that allows stock traders to trade directly with market makers/traders or specialists, rather than trading through stock brokers. Online trading or investment is a good and beneficial platform for all(beginners as well as experience)those who want to invest in the market. This kind of online trading can be done in foreign currency as People can trade with foreign market through internet as well. This way of investment is very attractive because you can make or earn lots of money very quickly.

What is Online Trading or Online Investment ?

Online trading or online investment has become very convenient for all of us. Now a days people are very much concerned for trading or investment in the market as it is the good source to earn more money. Online trading is very cost effective and faster trading, as you can contact your traders or customers via electronic mode/internet and get your business done in a minute itself. But for that you need to be very careful while handling online payments or receipts as many frauds take place. Many people use Demat account for online trading as it is one of the most convenient trading option. Some beginners will find it ( Demat account) difficult to handle as it is provided with so many options although you will learn. Online trading is also available on mobile handsets or gadgets with the new innovative ideas that can be very easy for you to handle.

Online trading Beginner’s guide to investment !

At the beginning, Online investment or Online trading guide for beginners can be intimidate because there are chances that some beginners might get threatening from other people as they have made a decision to invest in the market without broker or adviser. Most people likely to invest in the Stock Market with GOLD, SHARES and EQUITIES as it is the good source to invest or to earn money, But you need to understand demand and supply in the market as all prices of goods are determined by demand and supply. If there are more buyers in the market then prices will go up and if there are more sellers in the market then prices will go down. It is really the simple concept for all whether you are buying or selling stocks, bond, real state, currency pairs, commodities and other assets as well.

To begin with online trading one need to understand the basics on online investment or online trading –

- Stock Trader or Online trading account

- Finding the right and best online trading platforms

- Find the best stock broker

- Selecting the right kind of stock

- Understanding market and making investment decisions

Here we will detail about how to begin with the basics of online trading.As we detailed you about what is online trading now we will begin with 5 Bulletins of Online trading basics.

Read Also : Exclusive Nest Egg building guide for painless millionaire dreamer

# Stock Trader or Online trading account

Stock trader or online trading account is the platform for those who want to trade online or want to invest money for future purpose. Online trading account is used to buy and sell goods in the stock market. People also use this account for the security for their assets, bond, gold etc. This is the platform that provides online brokers to every single investor who wishes to invest or sell in the market.

How to open an online trading account ?

For opening an online trading account you need to follow few steps below :-

- First select your good broker or firm to start your trading account.

- Fees or charge of broker, some broker will charge you less or some will charge you more.

- Some broker will give you discount the basis of you investment conduct.

- Get in touch with your broker or firm for the information of account opening.

- Firm or broker will give to form to fill and submit the form along with documents and your address proof.

- After filling the form its time to verify your application form, and after it firm or broker will contact you via phone where you will ask for personal details.

- Once done, now you will be given your trading account details. Congrats, Now you have a online trading account.

This way you can create/open an online trading account.

# Finding the right and best online trading platforms

Lets find online trading platform that is suitable for you.

- HTML 5– It is most suitable platform for traders. They have best customer knowledge to fulfill their requirements. It is very easy to use and complete customer trading platform.

- Angel broking app – This is the smarter mobile trading app, It is very easy, simple and enjoyable app that gives you speedy secure stock trading experience.

- Sharekhan – It is the single platform for multiple exchange like cash, currency, mutual funds and many more.

- My value trade – This trading platform is built for secure and low trading by professional investors and traders. It provides you advanced charting, and new strategy to deal with.

# Find the best stock broker

For good and better trade you need to find best broker to start with. here is the list that you can find broker for you:-

- TD Ami trade – This is the no. 1 ranking broker that provides you tools, mobile apps(mobile trading), customer service. It is one of the best and experienced broker.

- Fidelity – It is the top class broker that drive customer experience and gives full satisfaction to their client through research report, quality tools.

- E*Trade – It is the option for house platform along with mobile apps. E*Trade is one of the well rounded broker.

- Sharekhan – It is also known as Trade Tiger. Sharekhan is one of the famous and good stock broker for trader, traders can easily rely upon it.

# Selecting the right kind of stock

Stock is the main reason for online trade. you need to find good stock for trade that enhance your capital and trade. Here is the list of some best stock that you can use for your trade.

- Trade in liquid stock- Liquid stock is relatively safe and easy to trade with as liquid stock tends to be more highly discounted than the other stocks are.

- Equity – It is one of the long term investment for financial market. people can buy and sell equity with the 100% security and it is one of the convenient method for market.

- Shares – Shares are the unit of amount in financial market which is also a king of stock in money market that people buy and sell for financial security.

- Mutual fund – Investing in mutual fund is one of the online safety and convenience of award winning online platform.

# Understanding market and making investment decisions

Understanding market and making investment decision is the most difficult for many people as it is related to money only. The two most important decisions an investor will make are when to buy and when to sell. The best time to buy stock is when others are pessimistic/negative. and The best time to sell stock is when others are actively optimistic/positive. You need to remember one thing while buying the possibility of high return is greater after its price has fallen rather than after it has risen.For example if stock of a same company X declined by 30% to 40% the first question will come in our mind is WHY? Why did the stock fall as it did? Did other stocks in the same industry experience a decline? If so, was it as severe? Did the entire stock market fall?For instance Stock in the same industry performed well there may the problem to other company(x). So it is always good that you should adopt new strategy and implement it. According to Benjamin graham, the father of value investing, once said, “The buyer of common stocks must assure himself that he is not making his purchase at a time when the general market level is a definitely high one, as judged by established standards of common-stock values.” His reference was to what we discussed as fair value under the section Stock Valuation above.

Read Also : Short term Investment Plans – Pros & Cons

Guidelines for Online Trading beginners

The best part of investment is that people always curious to know or invest in the market also those people who have never invested in shares will have strong opinions. Most people or beginners learn articles about investment from Online Trading Academy Website, it is good to learn or to get some idea actually before you invest your money in the market OR How to get started with online trading or investment? So here are some guidelines for beginners what they should do to get started with online trading. Let’s have a look :-

- Safety and Security – It is one of the major requirement for everyone before investing. You have to check the security features inbuilt in your account.

- Trading Plan – Trading plan is the first rule for beginners. Decide what you want to trade, how much you want to invest, your goal for profit, your tolerance for risk, and your devote to investment( every day, week, month or year ).

- PAN or Permanent Account Number Card – It is the primary thing which is required for financial or money transaction.

- Quality of information or account content – Make sure that you are getting a right and best information, research, support and tools which is being provided to you in a easy way.

- Credibility or reliability – Investing in the shares is not easy you must ensure that you are getting additional safety for your investment.

- Broker – Although broker is not required for online trading but also we can not go directly to stock exchange and buy or sell goods. So broker can help you for investment and provide other information.

- Trading account and Demat account – You can not hold shares in physical form for that you need to open Demat account or Trading account. it will help you to store your shares whatever you buy or sell in the market.

- Customer care – If you are investing your shares online then you need to know whether you are provided with customer care or not to solve your queries or problems.

- Position or Goodwill of Company – Make sure you are investing or trading with the company who has good position or reputation in the market which is not fraud or cheat.

- Maximum Profit – It is the kind of rule for the beginners to “lose small, win big”. To earn more you need to have good information or education about the online trading so that you can deal with the investors or traders or sellers.

Read Also : Investment on Stocks and Shares -Pros and Cons

ONLINE TRADING PLATFORM AND PRODUCTS TRADED ONLINE :-

Stock market or Equity market is a public network of economic transactions for the trading of stocks, shares and debentures etc at an agreed piece. Lot of people appreciate ease and comfort of working from their home and online trading is the best option for them. There are various online trading platform available for traders.

- Trading Account – For trading online you need to open trading account first, that you can use for your trading or investment.

- Demat Account – In simple term we can call it saving or investment account. Demat account can be use for security of money, shares, bonds etc.

- Angel Broking App – It is the smarter mobile online trading app. This app helps you to secure stock trading experience with all new technology in a easy and smarter way.

- Meta trader 4 – MT4 is online or electronic trading platform. It can be use for foreign trade also, as it is widely used by online trading foreign trading exchange.

- E signal – E signal is also online trading platform that is one of the smarter trading tool. It offers you the best charting platform to understand the trading.

- Forex – Forex is really a good way of trading. Online trading is a most convenient trading option.

More on Stock Trading

Stock market is a multiple platform where investors traded publicly, where companies are issued, brought and sold. It is also a platform for gamblers. although many people don’t considered it as gambling. Because when one invests in the stock market he will either win or loss depending on the condition of the market. For example if you put $200 on one roll of dice. If you by chance win, you win $X and if you lose it you would lose entire amount $200. Like wise when you invest in stocks there is always chance of either you win $X or lose $Y but sometimes its rare to lose, unless you invest in the company that go bust. Make sure you make good decision to invest in then money market.

What cause stock price to change?

Stock price changes are a complicated thing for a common man.

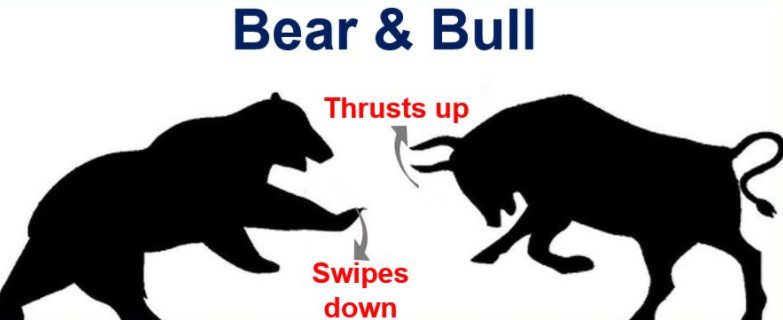

Prices of stock always dependent on its factors whether price will rise or fall. Prices are determined by two main factors i.e. DEMAND and SUPPLY. Other factors includes media, opinions or advise of well known investors, natural occurrence, political and social unrest, risk in the market, lack of suitable alternative. These factors are really important for price determining as it also tell us about inflation and deflation in the market that creates a certain type of sentiments i.e. bullish and bearish and a correspondence number of buyers and sellers. If there are more sellers than buyers in the market then price will tend to fall down and vice versa.

Stock Market is difficult to predict Why?

Stock market is difficult to predict because it is dependent on various factors including demand, supply, advertisement, preference of people, supplementary and complementary good etc these are the factors that keeps changing that’s why it is hard for investor to predict. Now Let’s assume stock prices have been rising for several years and investors realize that stock prices will be in trouble because of correction in the market. Therefore it is difficult for us to understand what exactly the trigger of selloff. However, some investors or traders seek right opportunity to come to invest in the market. But some investors are willing to take risk and jump in and it hurts them when they see stock moves higher and they are in loss. This raise the couple of key questions in our mind. If you’re on the sidelines, how will you know when to get in? If you’re already in, how will you know when it’s time to get out? If the stock market was predictable, these questions could easily be answered.

However, it is not. That’s why investors are required to considered these three issues.

1) First is understanding the point at which stock prices are fairly valued.

2) Second issue is the event that will cause a downturn.

3) Third or Final issue is understanding the human decision-making process. Let’s briefly look at these.

Stock Valuation

Every stock’s actual price is determined by market movement or activity. When an investor makes the decision to buy or sell, he will often compare a stock’s actual price to its fair value. For instance, if a trading stock value is $30 per share and its market value(fair value) is $35, it may be worth purchasing. conversely, it it trades at $30 per share but fair value is $25, then it is loss to investor because stock would be considered overvalued and he would only like to avoid it. What is the fair or market value of stock and how do you calculate it?? preferably, it would be based on some standardized formula. However there are many ways to derive this figure.

Here is the methods to calculate stock value or fair value of a stock –

Method 1) we can combine the value of company’s assets on its balance sheet, then minus depreciation and liabilities.

2) We can use this method to determine the intrinsic value, which is the net present value of a company’s future earning.

You can apply these two method but there are number of various method also. As different method drive slightly different result, Therefore sometimes it can be difficult to know if a stock is overvalued , undervalued or fairly valued. And even if stock price is overvalued, that doesn’t mean investor s will suddenly sell and prices will fall down. Literary, a stock can remain overvalued for quite some time and that is why it can be problematic to many investors to make buy or sell decision as prices of stock are always dependent on some moving average.

Triggering Event

Sometimes Many investors can affect because of triggering events as it is the king of cause that occurs due to tangible or intangible barriers. But these are the event are written to contract for investors to make them feel that they are on right place and help them to execute their plans. But you need to know which event will cause a trend reversal is similar too see around the corner of a solid brick building or company.

The Human Decision Process

Human decision process is depended on two components i.e emotion and action. Every individual has these two components inside them. We analyze our situation using logical side but when it’s time to ACT, we refer our EMOTIONS. For instance, when purchasing a car we might research the engine, fuel efficiency, amenities and many more. Such as we often question to our self like how do I look like in the driver’s seat? Does the car match my engine? Same happens with making investment decisions, what you want to buy and what other wants to sell, and what other wants to buy and what you want to sell as there is always an investor on the other side. But you must be able to make your good decision and analysis the relevant data. Therefore, it’s impossible to know everything you want to know and it will lead to process without any bias.

Conclusion

Investment decision is not a cup of tea. In this advanced world every one needs to be very smart to make their own good decision. Before investing in the market investors need to analyze everything about the company, broker, price of share market, choice of stock, about trading and what is demand and supply in the market and so on. It’s important to understand qualities that most top investors/traders have, to profit from the stock market! These qualities can be developed if there is willingness to succeed. With the help of trading skills, and business strategies you can invest in the market but traders need to adopt their own style of strategy. Hope this article will help you with your investment decision in the future.

1 Comment