Have you got any plan to apply for a loan or credit card then you must focus on improving your credit score . Because in the process of loan application your CIBIL score plays a key role in approval of your loan . So you must know all about how important it is to improve credit score.

Know about Credit Score and ways to improve credit score.

Credit Score represents the creditworthiness of an individual by analyzing that individual’s credit files. Credit score is expressed numerically by mainly analyzing individual’s credit report from trusted credit bureaus of that country .

You may be very well aware about the fact that banks sanction loan for Good credit score . Apart from banks almost all lenders like credit card companies , government departments , insurance companies other departments also take into account of your credit score. They do this to avoid risk of lending money and to prevent loss because of bad debt.

Your credit score is evaluated by lender to determine your potentiality based on this the lender decides the interest rate and your credit limit also they estimate how profitable it is for them if they lend money to you.

Every country have different trusted credit bureaus . Likewise in India there are four credit information companies which are given license to function by Reserve Bank of India.

RBI Approved Credit Information Companies in India |

|

| Ø The credit Information Bureau(India) Limited (CIBIL) | Ø Experian |

| Ø Equifax | Ø Highmark |

Though there are four licensed companies handling with credit information , CIBIL Score is considered as very important because The Credit Information Bureau (India) Limited (CIBIL) is the most oldest where the other ones are so recent.

CIBIL Report & CIBIL Credit Score.

CIBIL Credit Score is a 3 digit numbers that stands for representing an individual’s credit rating and credit history.

- A person with no credit history gets a CIBIL Credit Score of -1.

- Less than six months credit history will have a score 0.

- General credit score range falls between 300 to 900.

- 900 is the best CIBIL Credit score

Higher your credit score , higher are your chance to get loans so its very important to improve credit score.

How to get CIBIL Credit Report

If you want to generate you CIBIL Credit Report you can do it easily by following this steps.

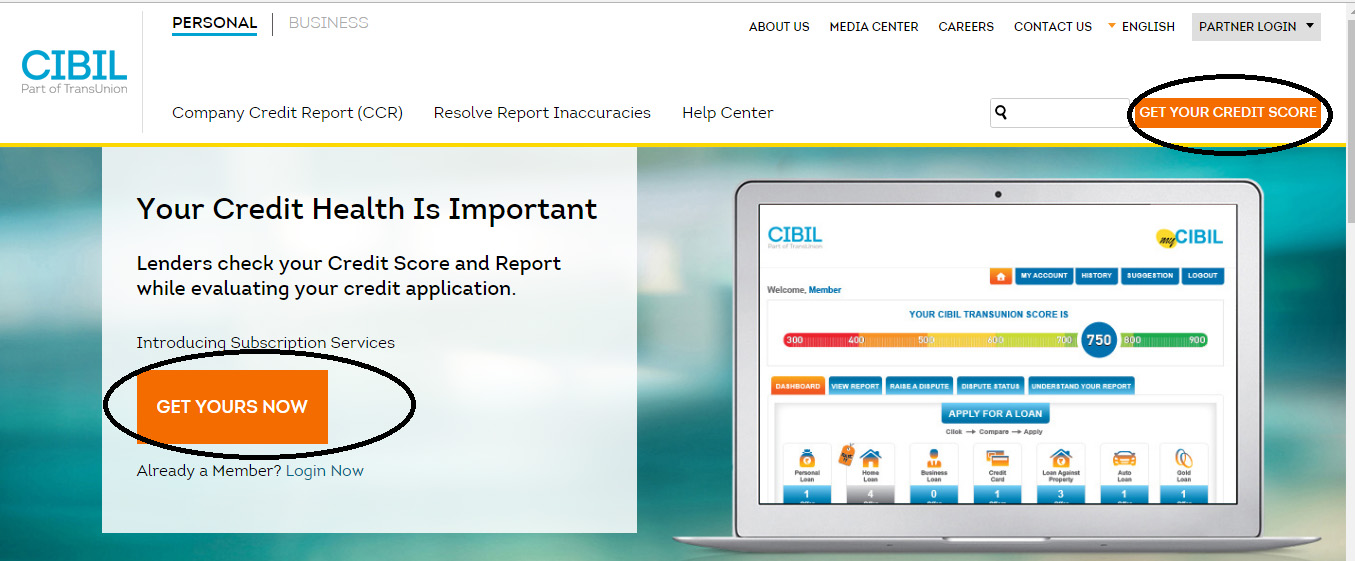

- Go to https://www.cibil.com/ , this is the official website of CIBIL ( Credit Information Bureau (India) Limited ).

- Click on “Get Your Credit Score” option as shown in the image.

or you can also click on the “Get Yours now” .

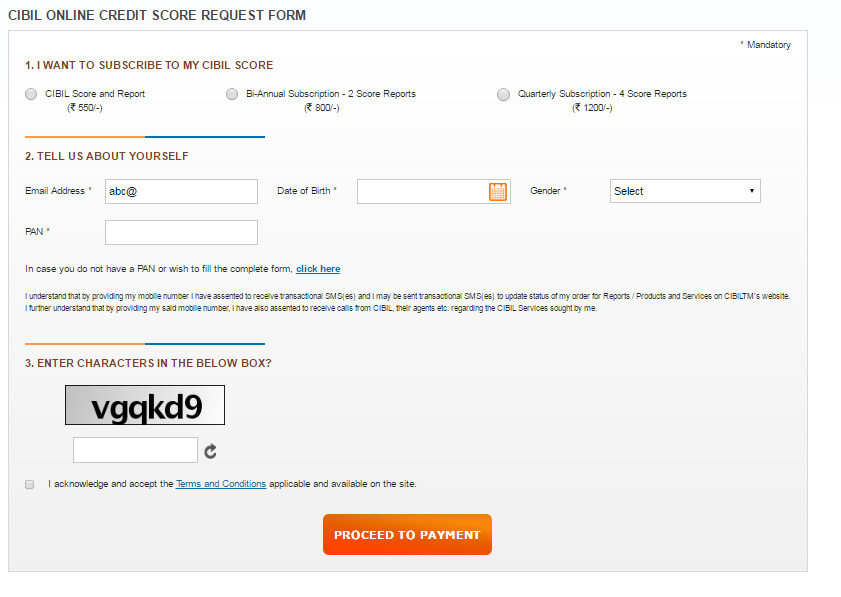

- Now this will direct you to a new page with CIBIL Online Credit Score request form.

- Fill the form with the requested information and proceed to payment & select your payment mode .

- You can pay using credit card or debit card or even via net banking .

- Click submit after the payment is done . Now you will be requested with certain authentication information.

- Once your authentication is completed successfully ,the process is done.

You will get your CIBIL Credit Report with CIBIL Credit score via e-mail within the next 24 hours.

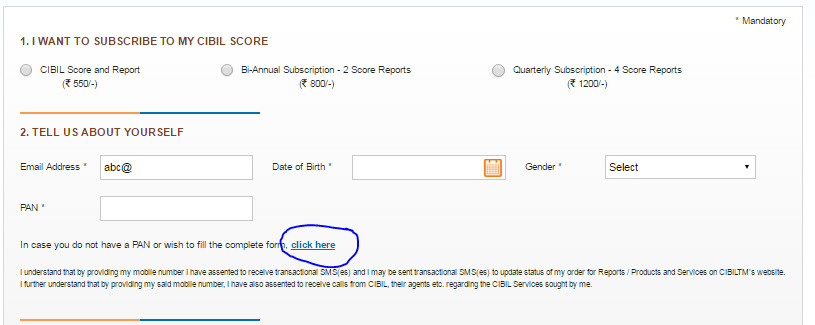

How to Get CIBIL CREDIT Report Without a PAN Card Number

- Visit CIBIL official page and click to check your credit score .

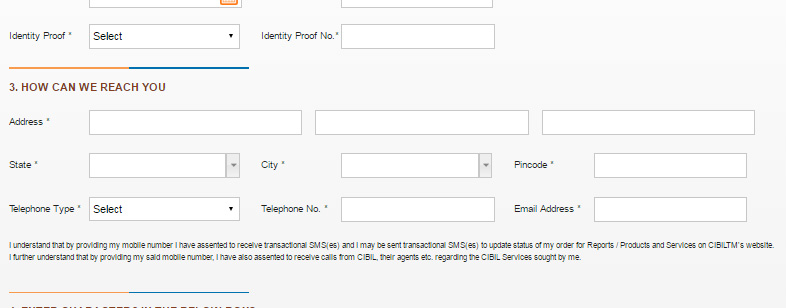

- In the CIBIL Online Report form you can find an option with samll font below the PAN number option. Click that and you get a page like this .

- Click there you will be asked to fill other information and attach identity proof .

- Just fill up the form and pay for it .

- Complete the authentication process successfully .

You are done with it , there you receive a e-mail within next 24 hours.

How your Credit Score is Calculated

Your CIBIL Credit score calculation is done on the basis of taking into account of certain factors. Primarily your payment history is taken into account whereas your repayment history record holds a weightage of about 35% while calculating credit score.

CIBIL score calculated based on these –

- Total credit balance available.

- Your total number of loans.

- Number of credit cards you possess.

- Balance between Secured and unsecured loans.

- Your credit utilization.

You can calculate your CIBIL score online easily as we have given the detailed step to calculate your CIBIL score.

Read Also : Gold purity and hallmark -Buyer’s Guide to choose the Pure Gold Jewellery

Good CIBIL Credit Score – Know your credit Health

| Credit Score | Credit Health | Rate of

Interest |

Chance to get Loan (Green- high chance Yellow-moderate Red- very less chance) |

| 750-900 | Excellent | Competitive rate of interest that is less rate of interest | Green |

| 700-750 | Fairly good | Competitive rate of interest that is less rate of interest | Green |

| 550-700 | Low score | High interest rate | Yellow |

| 300-500 | Very low score | Very high interest rate | Red |

This how your credit score determines your credit health and thus based on this relies your chances of getting loan when you apply for loan.

How to increase your Credit score fast -Tips for Improving Credit Score

You must have a good credit score for easy sanctioning of loans so know how to Improve Credit Score

- Know your Credit score by taking a credit report

- Pay your EMI and payments on time

- Mix your credit ( Unsecured & Secured credit)

- Limit your cards

- Limit your loans

- Don’t exceed your credit limit

- Don’t apply for loan or credit soon after its rejection.

- Reduce the frequency of taking credit

- Stop settlement of loans and credit cards

Take a look at where you stand before applying for a loan . You can check your CIBIL Credi score online through their official website within 24 hours of application. The most important factor that can improve credit score is by maintaining a good credit history by paying your bills and EMI’s without delay . Be on time with your payments always. If you maintain a mixed bag of unsecured as well as secured loans means this will help to increase your CIBIL credit score quickly.

Many of you will be having so many credit cards but to those people here is a strict advice . We strongly recommend you to reduce your number of credit cards because lesser the number of credit cards you own higher is your CIBIL credit score. Don’t take too many loans unnecessarily as it will give a bad impression on your potentiality to repay loan .Thus keep your loans in limit to increase your credit score .Also reduce the frequency of taking loans for maintaining a good credit score.

If you have applied for a loan and for some reasons if your loan application gets rejected then don’t apply for loan again without improving our CIBIL score .

These are the ways to improve your credit /CIBIL score fast.

What is the good Credit Score for getting loan approval easily.

If you are looking for a personal loan , then banks look for high CIBIL Score . This is because personal loans are generally high risky for the lenders as it is unsecured loan.

If you are looking for secured loans such as home loan , then you need comparatively less credit score than what you must require for taking a personal loan or car loan.

Find out the general credit score for home loan, car loan and personal loan.

| Loan Type | Personal Loan | Home Loan | Car Loan |

| Minimum CIBIL Score/ Credit Score | 750 and above | 700 and above | 750 and above |

So always maintain a CIBIL Credit score which is fairly above 700 for getting easy loan sanction.

Factors that will influence your Credit score negatively .

- Increased Credit Limit

- Irregular payment history of delayed EMIs

- High percentage of Unsecured loans(personal loans)

- So many credit cards

- Multiple loans

- Standing as guarantor for someone in the past who didn’t pay back the loan amount.

So this is all about you Credit score which is so essential thing you must know when you have a plan to apply for a loan . So follow the steps listed to improve Credit score.

or you can also click on the “Get Yours now” .

or you can also click on the “Get Yours now” .

0 comments